Our approach is built around volume growth. We have to have volume growth, I think, to be successful.

– Samuel Hazen, President and CEO Hospital Corporation of America

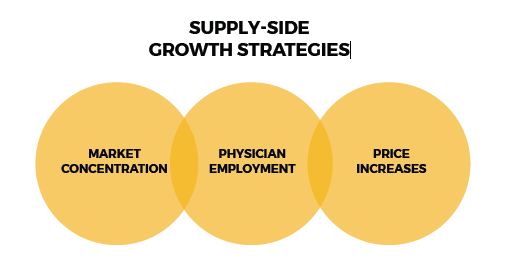

HCA is not alone in its focus on growth, however, how should it and other hospitals and health systems grow? Many have, over recent decades, focused on aspects of their business they can control directly in order to do so. This has led to a preponderance of inward facing strategies — consolidating market position through aggressive M&A and expanding outpatient settings, locking up referral streams through physician employment, and exerting price pressure on payers by leveraging market presence, for example. Movéo thinks of these strategies in terms of supply-side growth, since each in some way requires power over the supply of healthcare services, whether it be access, labor, or pricing.

M&A has helped providers on multiple fronts; it utilizes lower acuity settings, builds brand recognition, and allows for referrals across a distributed care network. Many markets are now highly concentrated, making attractive acquisition targets fewer and far between. Besides, if too much concentration occurs, regulators cast a weary eye, diminishing this strategy further. Additionally, sources of capital for new acquisitions are harder to come by.

On the physician front, nearly 40 percent of U.S. physicians are “locked-up” by a hospital or health system (a 50 percent increase over the period from 2012 to 2015). There are simply fewer unaffiliated physicians out there to hire, and competing for the loyalty of the remaining independents, while worthwhile, is a hard slog.

As for price increases, they become tougher when there is softening demand — which there is. The windfall of those newly insured by the Affordable Care Act (ACA) has topped out, and contemplated federal ACA reforms (or repeal) will mean fewer, not more, insured in the coming years. The “new normal” of 1-2 percent growth in admissions — which may even be optimistic — is down from the recent 3-4 percent annually. There’s also been a slowdown in Medicare spending growth, even as the number of Medicare beneficiaries continues to rise. Population health initiatives are accounting for additional erosion in inpatient volumes, too.

There is a strong consumerism “movement” in healthcare fueled primarily by two trends: patient cost sharing and the shift to outcomesbased payment (i.e., value-based programs). Patient involvement and active management of cost are increasing as consumers now have more “skin in the game” as a result of highdeductible insurance plans. This leads to price shopping and fewer elective surgeries and procedures, further dampening volumes.

Hospitals and health systems can also expect outcome or value-based payments to rise and fee-for-service payments to continue to decrease. While not without its challenges, a real benefit to providers pursuing outcomes-based healthcare is having a patient-centered vision that motivates everything they do. Delivery systems that will succeed under these models will be those that can increase their number of lives under management. The key to increasing patient volumes, then, will be providing a consistently strong experience of care from the patient’s perspective. In such an environment, hospitals and health systems that remain inward facing in their strategies are at a distinct disadvantage, and may quickly lose relevance (and revenue).

For these reasons, we believe providers need to urgently reassess their strategies for growth beyond the supply side.

Demand-side growth

To grow patient volumes in the future, providers will need to generate demand for their services — earning marketing share instead of achieving it through supply dominance. This will be a paradigm shift for many, as it relies heavily on marketing strategy. While this may sound like an indictment of current hospital marketing, it is not meant to be — when engaging in a supply-side growth strategy, marketing is not an essential requirement for success. This is why so many providers have rarely gone beyond traditional brand pronouncements featuring caring physicians smiling at happy patients — they haven’t needed to. There are, however, more powerful levers of growth at their disposal once they choose to take a demand-side approach.

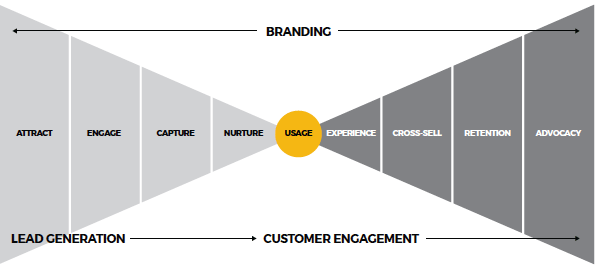

While many readers may be familiar with the concept of a “sales funnel” as a customer input-output metaphor, for others (especially in healthcare, an industry that has historically lagged behind others in marketing) it merits explanation. By definition, a funnel is the ideal process that consumers go through as they move from being someone who could potentially be a patient to an actual one. We say “ideal process” because we know that the funnel has “holes” in it — consumers looking for healthcare services go off to check ratings, prices, outcome information, and then search again.

They see ads or read U.S. News reviews. They talk to friends, over the back fence and on social media. But despite these detours, the metaphor is still a good one, because a motivated shopper inevitably returns to the funnel. Whenever and wherever they do, it is the job of brand to help move them through its different stages until they “fall out of the funnel” and become customers. Yet, this is where the traditional sales funnel metaphor does break down. Movéo believes demand generation should be viewed across a dual funnel that is distinguished from the old funnel in important ways:

First, the funnel should be viewed on its side (not vertically) as a reminder that there is no “force of gravity” bringing patients to your hospital or system — demand must be constantly generated to overcome market inertia or thwart competitive efforts.

Second, there are actually two funnels — one for the new patient journey and the other for the existing patient journey. The latter often receives scant attention from marketers, even though it costs many times as much to attract a new patient than to keep an existing one.

Third, demand generation involves an interplay among three drivers of growth — branding, lead generation, and customer engagement. Not coincidently, these three drivers overlap the entire patient journey. That is why we need to look at all three more closely.

The (real) role of brand

Brand is one of the most misunderstood ideas in business. The thinking in many organizations (and not exclusively healthcare ones) is that brand has to do with the marketing department as opposed to the firm’s total strategy. This leads to disconnects with the brand once it is experienced by patients. A bad personal exchange with an admission representative or an egregiously late lab result means the next time the patient sees advertising touting the brand’s bonafides, an eye roll (or worse) occurs, because a promise made in that ad has not been kept in practice. Other organizations may recognize the power of an internalized brand, but do not have the resources to implement it or, perhaps, the will — branding is not a “one-off” project but long-term strategy that requires continuous reinforcement.

Looking at the bright side, an enormous opportunity exists for many hospitals and health systems to enhance their brand if ALL stakeholders who work with the entity understand it and are living it. Nowhere is this more important than in healthcare, where there are thousands of touch points and interactions with the brand made daily. This is why in our dual funnel diagram, brand stretches across the entire patient journey. It is perceived by prospective patients and experienced by existing ones. If it is “broken,” the other two drivers of growth (i.e., lead generation and customer engagement) will also be hindered — if not rendered nonfunctional. On the other hand, a strong brand can lead to greater:

- Price leadership

- Quality perception

- Trust (involvement and esteem)

- Awareness

- Market share

- Intent to trial/use

- Engagement

- Satisfaction

- Advocacy/referrals

Plainly stated, branding (internal and external) can be a huge driver of growth.

The role of lead generation

The term “lead generation” is actually something of a misnomer in that it really involves a host of activities dedicated to the goal of new patient acquisition. The actual lead generation part of the larger process typically uses valuable content or other marketing efforts to engage anonymous individuals (suspects), identify them (leads), build the relationship (prospects), and then, by earning their trust, turn them into patients (customers), either immediately or over time.

The key to success for any lead generation effort is to provide the individual with a compelling reason to exchange his/her contact and perhaps other information (e.g., health condition of interest). This is accomplished through a content strategy that identifies and prioritizes content such as informative videos, interactive assessments, seminars or webinars, testimonials, eZines, or many other tactics all designed to facilitate the aforementioned exchange.

Such content works well in not only establishing but nurturing relationships — moving prospects through the funnel — with the goal of eventual hospital or health system trial. Developing high-quality content for different stages of the journey can be a daunting task for many lean marketing departments, but it is an essential one to successfully actuate a lead generation strategy. Luckily, technology such as marketing automation systems has made the distribution, if not the creation, of such content much easier. Lead generation, once successful, leads to an important event — usage. At this point, a prospect becomes a paying customer, and the relationship with the brand is set on an entirely new course.

The role of customer engagement

The first rule of any business should be to retain customers and build a loyal relationship with them. That is why it is amazing how little effort is expended by so many organizations in marketing to their existing patients. While the data may vary in healthcare, studies across industries show that the probability of selling to an existing customer is 60-70 percent, while the probability of selling to a new prospect is 5-20 percent. Furthermore, existing customers are 50 percent more likely to try new products/services and spend 31 percent more when compared to new customers.

In light of this data, it’s easy to see why a customer engagement strategy that emphasizes customer retention and lifetime customer value will pay big dividends. That is why Movéo has included customer engagement as its own funnel, with an entirely different journey than that of a prospect. Here, the possibilities for growth not only include perfecting the customer experience to encourage repeat business and the crossselling of services, but the “holy grail” of customer engagement — advocacy. Loyal patients are those who keep going to your PCPs, your hospitals, your ambulatory centers. Advocates are those customers who do those things, but also actively champion your brand and influence the choices of others.

The concept of advocacy is hardly new — people have been recommending brands since they first existed. But today, the power and possibility of advocacy has reached a new scale thanks to social media. “Word of mouth” can become a massive amplification of your own marketing (and a free one at that).

Defining demand generation success

As the saying goes, that which cannot be measured cannot be managed, and demand generation strategies are no exception. Our first driver of growth, brand, is often perceived as an intangible that can’t be measured. While studies have been done by companies such as Interbrand that “prove” financial impact on the bottom line of organizations that have strong brands, these are still correlative. The problem is that it is difficult to quantify the human emotion created by brands. This emotion is what ultimately creates (in the words of Kevin Roberts, former CEO of Saatchi & Saatchi) “loyalty beyond reason.” Jeremiah Gardner, another brand expert and author of The Lean Brand, offers an interesting solution to this quandary involving measuring three metrics:

Interaction

Any time a person expresses some connection with a brand and an affinity for what it has to say, that’s interaction. Measuring interaction is simple: Does someone click on the banner ad? Do they watch the video? Do they open the email?

Engagement

Engagement is about the quality of the interaction. It’s how far someone is willing to go once they’ve interacted with your brand. Will they provide their email address? Do they comment on your post? Do they actually attend your weight loss seminar they registered for?

Participation

When a patient is devoted to your brand and performs actionsto exhibit that devotion, that’s participation. Does someone give your brand a high net promoter score? Does someone consistently show up to your events? Do they recruit others to the brand?

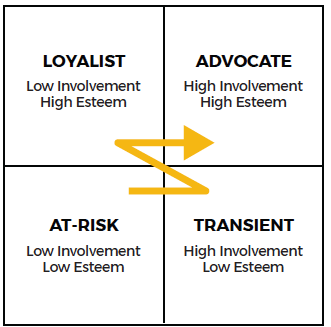

Through the lens of these three metrics, we can begin to form a model for estimating your brand’s emotional value. The diagram to the right shows an interesting way to look at this. Here, emotional investment (involvement and esteem) represents dimensions of brand health. When both measures are high (upper right quadrant), patients are likely to become advocates. When both are low (lower right quadrant), patients can be viewed as ripe for competitive poaching.

Through the lens of these three metrics, we can begin to form a model for estimating your brand’s emotional value. The diagram to the right shows an interesting way to look at this. Here, emotional investment (involvement and esteem) represents dimensions of brand health. When both measures are high (upper right quadrant), patients are likely to become advocates. When both are low (lower right quadrant), patients can be viewed as ripe for competitive poaching.

Compared to branding, lead generation is relatively straightforward to measure. Three metrics are key: conversion rates measure program efficiency, velocity identifies the time to move across stages, and volume measures the demand at each stage. Understanding each metric is important because it directly impacts resources.

For example, an inefficient lead generation process requires more activity (and budget) at the “attract” stage to reach a patient volume goal. But in most healthcare organizations (at least the ones we’ve had experience with), budget is a constraining factor, so maximizing the efficiency of the program by measuring and improving conversion (“engage,” “capture,” and “nurture”) is critical.

As for customer engagement, this driver can be the easiest to measure. Although most hospitals and health systems have implemented EMRs and revenue cycle management platforms, the most progressive organizations are also leveraging customer relationship management software to get a 360-degree view of patients. These systems excel at:

- Weaving together multiple sources of data, including patient demographics, psychographic, social, behavioral, clinical, financial, website, and call centers to provide a comprehensive view into patient and consumer habits and activities.

- “Crunching” the data to determine the best marketing opportunities, the best targets for those opportunities, and the best ways to communicate with those targets.

- Identifying the return on investment from customer engagement campaigns.

Many CRM healthcare vendors (e.g., Healthgrades, Oracle, Evariant, VerioMed, Influence Healthcare) use a selection of predictive models built at the program, service line, and procedure level to determine the appropriate customers to target with a high degree of accuracy. This helps determine what type of communication may be best received by patients. For example, it can identify at-risk patients for breast cancer, fill in engagement gaps along the care continuum, and encourage patients to stay current on healthy practices. A CRM program enables you to send the right message to the right people at the right time, thereby allowing them to take better care of their health — while you earn their loyalty through proactive, personalized communication.

Key Takeaway

Every hospital or health system is trying to grow — it is the strategies behind that growth that need to change. While supply-side growth can still work in some cases (e.g., mergers persist despite impediments), and growth can take other forms (e.g., new partnerships along the continuum of care or expanded physician reputation and referral programs, etc.), demand-side growth from increasing market share will yield the greatest returns in the future. Obviously, there will be winners and losers in such a strategy, and not every hospital or health system can succeed. Also, in markets where there might not be enough demand or too much competition around high acuity patients or lower margins, divestiture rather than “making a last stand” may be the best strategy. However, for most hospital and healthcare systems, recognizing the three drivers of growth — branding, lead generation, and customer engagement — and enacting a strong, integrated effort behind each one is the best way to significantly better their odds.

Author

Brian Davies

Managing Partner

bdavies@moveo.com

About Movéo

Movéo is a demand generation agency that focuses on three drivers of growth to help clients in healthcare and B2B attract, secure, and retain more customers. For more information visit moveo.com.